Variances

In a number of BudgetLink reports, variances between Actual and Budget values are calculated. There are two types of variance calculations: Standard and Impact. The Standard variance calculation is used in MYOB and it is the same for all account types (Actual - Budget). The Impact variance calculation is the default used in BudgetLink reports and it differs for account types such that variances that have a negative impact on the business are displayed as negative values and those with a positive impact are displayed as positive values. The Impact variance calculation by account type is shown below.

| Account Type | Value Formula | Percentage Formula |

|---|---|---|

| Asset | Actual - Budget | (Actual - Budget) / Budget |

| Liability | Budget - Actual | (Budget - Actual) / Budget |

| Equity | Budget - Actual | (Budget - Actual) / Budget |

| Income | Actual - Budget | (Actual - Budget) / Budget |

| Cost of Sales | Budget - Actual | (Budget - Actual) / Budget |

| Expenses | Budget - Actual | (Budget - Actual) / Budget |

| Other Income | Actual - Budget | (Actual - Budget) / Budget |

| Other Expenses | Budget - Actual | (Budget - Actual) / Budget |

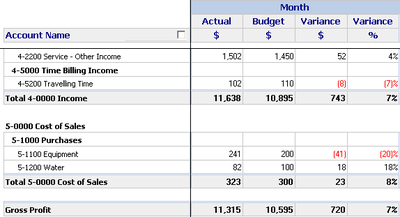

The example shows how these formulas are applied in a Profit and Loss report.

For an Income account, if the Actual value is greater than the Budget value, then the Variance is calculated as a positive as earnings were higher than expected and this has a positive impact on the business.

However, for a Cost of Sales account, if the Actual value is greater than the Budget value, then the Variance is calculated as a negative as the cost was greater than expected and this has a negative impact on the business.

If you would like to change the calculation from Impact to Standard in your BudgetLink reports, please contact Accounting Addons for more information.